Leading Debt Consultant Singapore: Specialist Services for Debt Resolution

Leading Debt Consultant Singapore: Specialist Services for Debt Resolution

Blog Article

Transform Your Financial Circumstance With Expert Financial Obligation Consultant Solutions Tailored to Your Distinct Needs and Conditions

Understanding Debt Expert Provider

Lots of people facing financial difficulties may benefit from the know-how supplied by debt specialist solutions. These professionals specialize in assisting clients who are bewildered by financial obligation, offering tailored remedies to assist them gain back control of their monetary scenario. A financial debt specialist's main duty is to review a customer's financial condition, consisting of revenue, expenditures, and arrearages, before creating a thorough strategy to resolve their distinct needs.

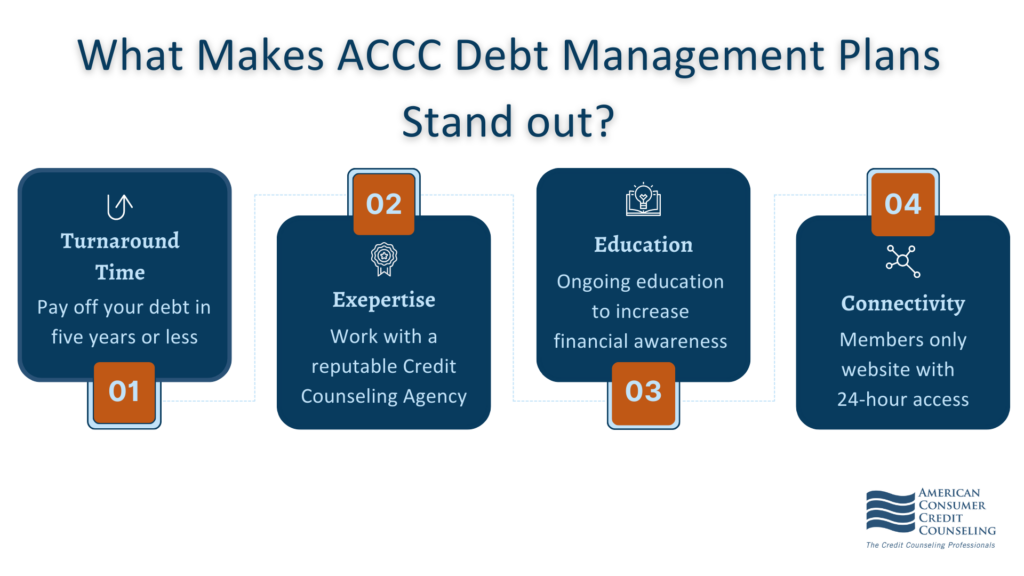

Debt expert solutions typically encompass a variety of offerings, such as debt consolidation, budgeting support, and arrangement with creditors. Professional guide customers via the intricacies of numerous debt relief choices, guaranteeing they comprehend the implications of each choice. They also equip customers by educating them on financial proficiency, enabling better decision-making in the future.

Moreover, financial obligation consultants function as supporters for their customers, functioning straight with creditors to work out reduced passion rates or repayment strategies that fit the client's budget. This advocacy can considerably minimize the tension linked with handling debt. Overall, comprehending the function of financial obligation professional services is necessary for individuals seeking effective remedies to their economic troubles and going for long-term financial security.

Benefits of Personalized Methods

Personalized approaches offered by debt experts can considerably improve the effectiveness of financial debt relief efforts. By tailoring options to individual scenarios, consultants make sure that clients get ideal guidance that aligns with their one-of-a-kind financial situations. This tailored method not only addresses prompt debt worries but additionally develops a sustainable path toward lasting financial health and wellness.

An additional advantage is the emotional assistance supplied by financial debt experts, that understand the mental toll of financial tension. best debt consultant in singapore. By fostering a collective environment, clients feel encouraged and inspired to abide by their financial obligation settlement strategies. Ultimately, customized methods not just promote financial debt administration yet also boost general economic proficiency, equipping clients with the knowledge and devices necessary for an extra secure financial future

Evaluating Your Special Financial Scenario

Analyzing your unique financial situation is an essential initial step in the financial obligation alleviation procedure. This assessment involves a comprehensive examination of your financial landscape, including revenue, financial obligations, possessions, and expenditures. By collecting this details, you can much better comprehend the root creates of your financial difficulties and determine potential services.

Begin by compiling a thorough listing of all your earnings sources, such as salary, freelance work, or investments (best debt consultant in singapore). Next, track your month-to-month expenditures, comparing fixed costs (like lease and energies) and variable costs (such as eating in restaurants and entertainment) This will assist you determine areas where you can reduce and designate more funds towards financial obligation repayment

Additionally, make a complete stock of your financial debts, including credit report cards, loans, and any kind of outstanding bills. Keep in mind the rate of interest, minimum settlements, and due days for every commitment. This details will be crucial for prioritizing your debts and selecting one of the most efficient settlement strategy.

Actions to Locate the Right Specialist

When browsing the complexities of debt administration, picking the right expert is important to accomplishing your monetary objectives. Start your search by recognizing your particular requirements-- whether you need credit report therapy, financial obligation settlement, or a thorough economic strategy. This clarity will assist you target specialists with the ideal experience.

Following, perform thorough research study. Try to find specialists with trustworthy certifications, such as those from the National Foundation for Credit Score Therapy (NFCC) or the Organization for Financial Counseling and Preparation Education (AFCPE) These qualifications frequently suggest a level of professionalism and reliability and adherence to ethical standards.

Look for out recommendations and review customer reviews to evaluate the expert's efficiency. Throughout these meetings, inquire concerning their method to financial debt management, fees, and the strategies they utilize.

Success Stories and Transformations

Changing monetary lives via efficient financial obligation administration is a testimony to the power of specialist guidance. Lots of people and households have actually discovered themselves overwhelmed by financial debt, dealing with overwhelming challenges that seemed impossible to overcome. Nevertheless, with the help of professional debt professionals, they have actually experienced amazing transformations.

Take, as an example, Sarah, a single mommy who had a hard time with bank card debt surpassing $20,000. After engaging with a debt consultant, Sarah established a personalized payment strategy that enabled her to settle her financial debts and minimize her monthly settlements considerably. Within 2 years, she became debt-free, reclaiming control over her financial resources and her life.

In A Similar Way, John and Lisa, a couple burdened by pupil car loans and medical bills, looked for assistance when their my explanation monetary circumstance came to be untenable. Their specialist helped them browse different alternatives, including financial obligation administration programs and working out negotiations. Ultimately, they accomplished a 50% decrease in their complete financial debt, enabling them to save for their kids's try this website education and learning and home ownership.

These success stories exemplify exactly how customized financial obligation specialist services can lead to extensive economic makeovers, providing clients with the tools and techniques required to accomplish long lasting stability and tranquility of mind.

Conclusion

In conclusion, expert financial obligation professional solutions use a transformative technique to handling financial obstacles. By supplying tailored approaches based on private conditions, these experts encourage clients to achieve efficient financial obligation alleviation and enhance monetary proficiency. The extensive assessment of special financial circumstances and the application of customized solutions help with a path towards economic security. Engaging with competent consultants eventually boosts the capability to browse future monetary responsibilities, cultivating a much more secure economic outlook.

Navigating the complexities of financial obligation can often really feel frustrating, yet the right debt expert services can supply essential advice tailored to your certain monetary scenarios. A debt consultant's key duty is to evaluate a client's useful reference monetary status, including earnings, expenditures, and impressive debts, before developing a thorough technique to address their unique needs.

Debt specialist solutions typically include a range of offerings, such as financial obligation combination, budgeting assistance, and settlement with creditors.Individualized methods provided by financial debt specialists can considerably improve the performance of debt relief initiatives. After engaging with a financial obligation specialist, Sarah created an individualized payment plan that allowed her to settle her financial obligations and decrease her monthly settlements dramatically.

Report this page